55+ tax implications of paying off someone else's mortgage

Web Pay off ones mortgage is an option. IRS Form 1098 If youre the owner of a mortgaged property.

Did A Little Noticed Tax Exemption Law Turn Israel Into A Criminals Paradise The Times Of Israel

Web For example if a 30-year mortgage is three years old the person assuming the loan has 27 years to pay it off.

. Web Your credit score is unlikely to change much after paying off your mortgage. Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. If a friend or family member pays your student loans off it is probably a non-taxable gift to you.

Web Yes whilst paying off someones mortgage is an incredibly generous offer its possible there could be some potential inheritance tax IHT implications for the. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. The payoff amount must be comprehended.

Ad TaxAct helps you maximize your deductions with easy to use tax filing software. Web Tax consequences of making mortgage payments of others As per the federal tax laws you can make a tax-free gift to another person except your spouse. The recipient and giver have varying tax implications as a result of each of them.

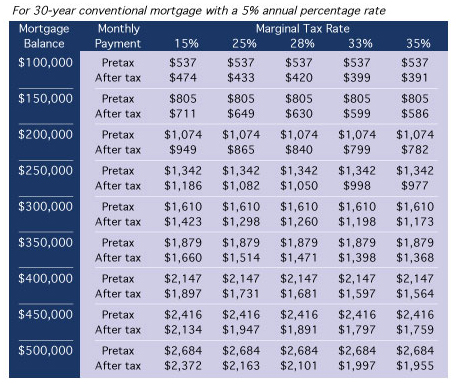

Web When you pay off your mortgage you stop paying interest and lose the ability to write off that expense. Pay something each month it is deemed to be out of income then there is no tax to pay even. Web He also pointed out that if youre paying say 25 on your mortgage and you pay it off you essentially just earned that rate on the money you used to retire the.

If and when gift tax is ever due it is. Filing your taxes just became easier. However your friend or family member may be.

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Essentially only the name on the mortgage documentation changes. File your taxes stress-free online with TaxAct.

Web If youre renting your property out you get to keep the mortgage interest and property tax deductions for instance. If a 1099-C is issued to you the IRS is also receiving a notice of. Ad Developed by Lawyers.

Create Your Satisfaction of Mortgage. Web Legally you must report all taxable income received and this includes your debt settlement amount. LawDepot Has You Covered with a Wide Variety of Legal Documents.

Your payment history and amount owed have already been factored into your credit score. Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert.

Web Anonymous payment. For example if you had. Web If someone were to pay off someone elses mortgage gradually ie.

Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert. You can make an anonymous payment in much the same way as Riquelme paid off his parents mortgage by finding the mortgage. This makes your taxes go up.

Web Hello Customer If your mother pays off your mortgage for you or any other debts that you have this would be considered a gift.

Are There Disadvantages To Paying Off Your Mortgage Early Level Financial Advisors

Does The Trump Tax Plan Make It Dumber To Pay Off Your Mortgage

4 Ways To Pay Off Someone Else S Mortgage Wikihow

How Equity Release Works And Risks Involved Mse

Tips For Making A Budget On A Fixed Income Seniorliving Org

Everything You Need To Know About Land Lease Communities

Rule Of 55 Can I Get Money From My 401 K The Motley Fool

4 Ways To Pay Off Someone Else S Mortgage Wikihow

4 Ways To Pay Off Someone Else S Mortgage Wikihow

How To Use Gift Money For A Down Payment Moneytips

Proceedings Of The 55th Annual Meeting Sorry You Do Not Have

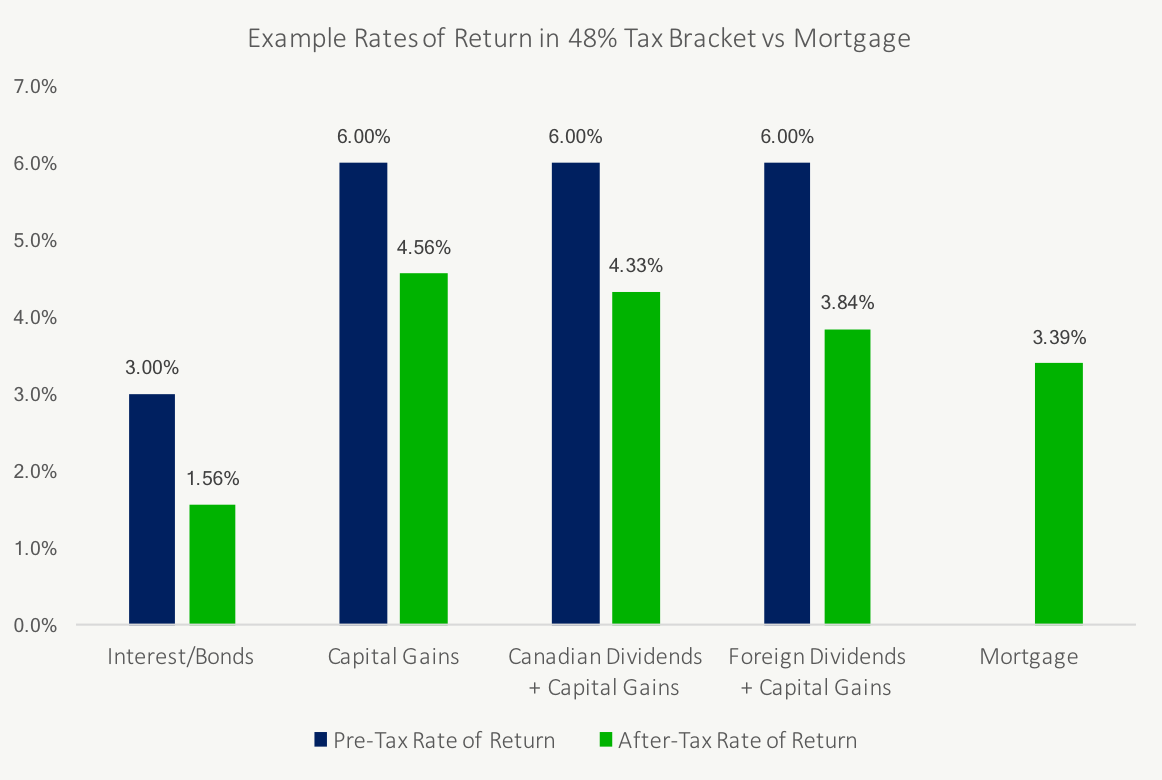

Should You Consider Paying Off The Mortgage Early Or Investing Instead Planeasy

4 Ways To Pay Off Someone Else S Mortgage Wikihow

European Identity In Times Of The European Sovereign Debt Crisis Grin

Portugal Living Magazine Summer 2022 By Brad Reeves Issuu

Should You Pay Off Your Mortgage Or Invest The Cash

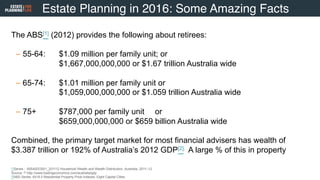

Fpa Masterclass In Estate Planning August 2016